Selling My Home

Great Deals

Property Search

Foreclosures

Income Property

New Construction

Downtown

Neighborhoods

Condos

Rentals

Investor Central

Real Estate Blogs

Resources

Testimonials

Webcams

Client Log-in

Contact Us

Just The Facts, Jack

Fort Lauderdale & South Florida Housing Market Stats

Ft Lauderdale Real Estate News 9/22/2023

Fort Lauderdale Home Prices Show Appreciation of 14.3%

You Call That a "Down" Year?

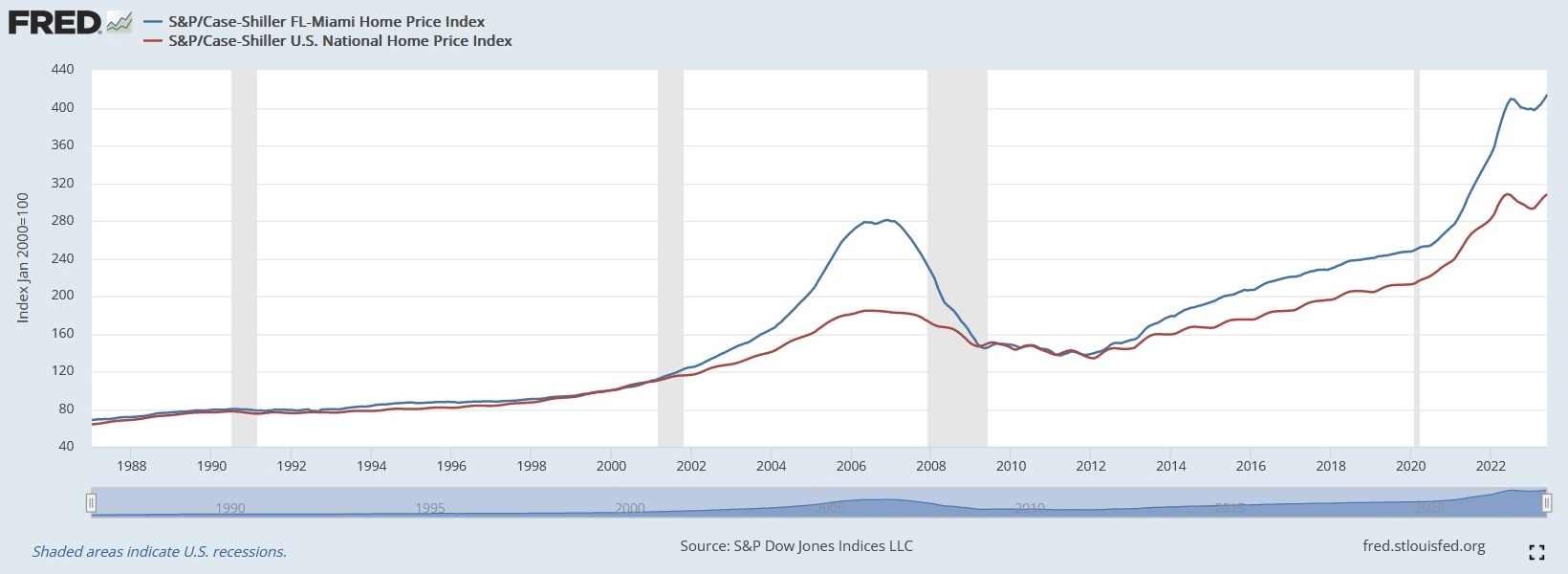

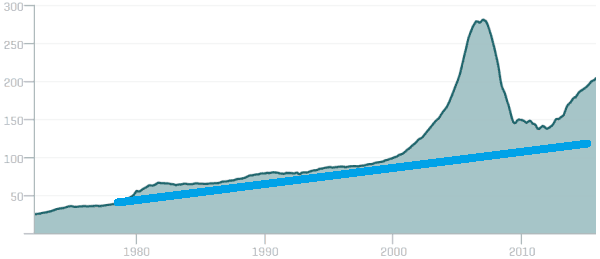

Blue Line is S&P Case-Shiller Home Price Index for South Florida Metro Reporting Area

(Miami-Dade, Broward and Palm Beach Counties) from 1987 thru May, 2023

Red Line is the Home Price Index for the U.S.

Following a staggering rise of 36.2% in 2021, and 18.9% in 2020, the Real Estate Market in Fort Lauderdale was supposed to take a bit of a breather. And we suppose you could say it did. According to 2022 Year End statistics released by Florida Realtors, data generated by compiling sales reported through the MLS of local realtor associations throughout the Sunshine State, the Average Sale Price for a Single Family Home in the city of Fort Lauderdale only rose 14.3%.

Yes. ONLY 14.3%.

Which raises two interesting questions:

The first – what kind of Real Estate Market are you in when 14.3% appreciation is considered a "down" year?

The second – why is anybody investing in Real Estate anywhere else?

With mortgage rates high and inventory tight, following two years of explosive growth, you would expect Real Estate to cool off, consolidate, as people became accustomed to the new pricing reality.

Apparently, in Fort Lauderdale, that translates to 14.3%.

An even more telling stat, perhaps, is the "Median Percent of Original List Price Received," which calculates the spread between asking and closing price. Historically, the Median Percentage of List Price Received for a Single Family Home in Broward County has been around 95-96% of the property's asking, with Condominiums and Townhomes around 94-95%. In 2022 the Median Percent of List Price received for a Single Family Home was 100% and 99.1% for Condos and Townhomes.

This is a Median statistic, remember. That means of the 14,438 sales of Single Family Homes in Broward County in 2022, at least half of those were higher than full asking price.

For those of you keeping score at home, that's two years in a row the Median Percent of Listing Price Received in Broward County has been 100%.

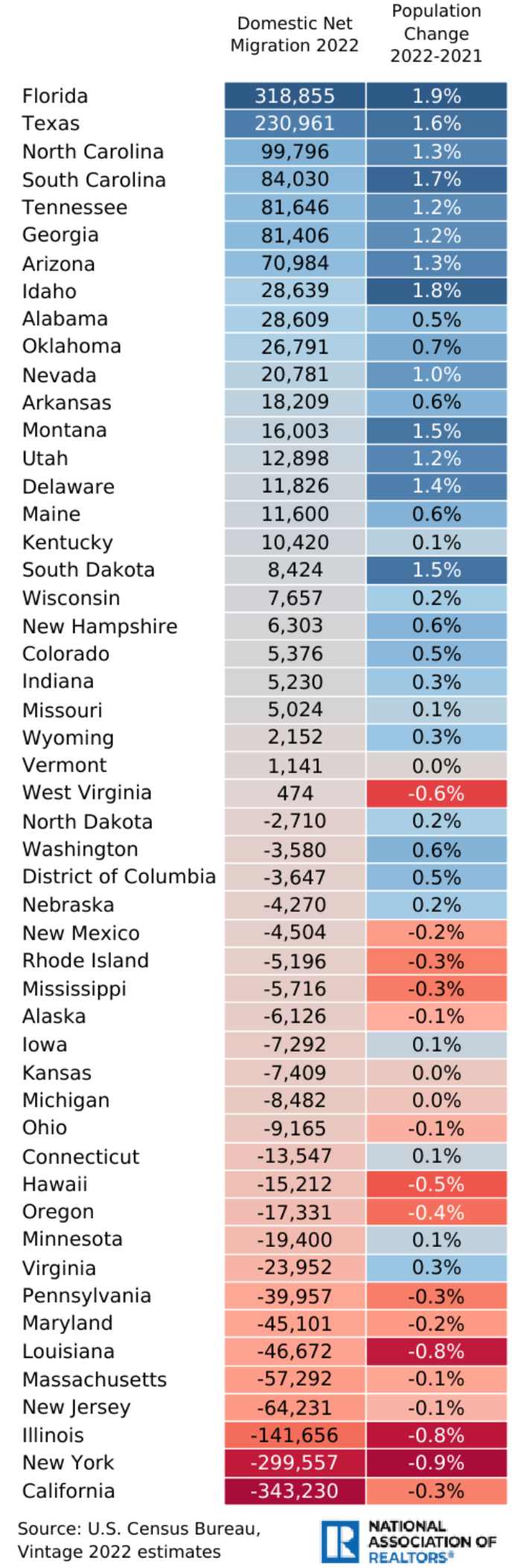

What The Heck Is Net Domestic Migration?

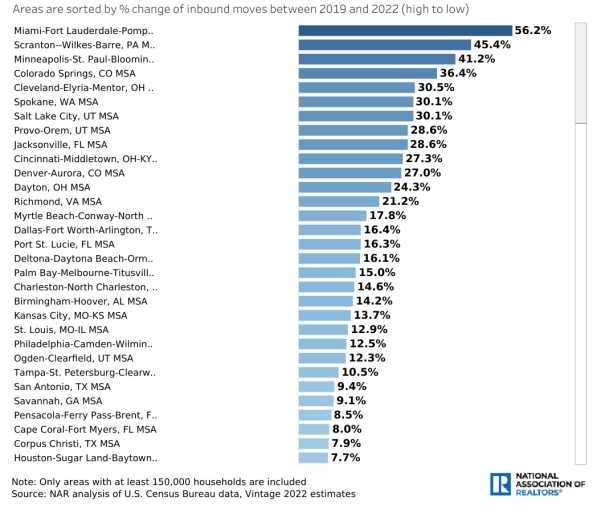

A few months ago we reported interesting numbers released in an analysis of U.S. Census Bureau data by the National Association of Realtors concerning Net Domestic Migration. This is a fancy way of saying Who's Moving Where From to Where?

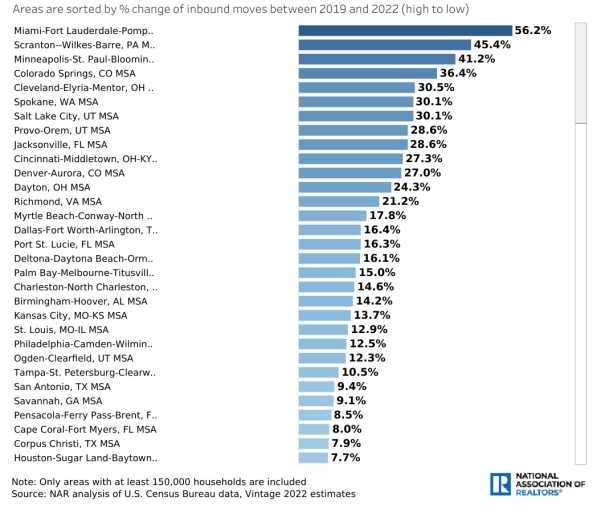

According to this study, tracking the percentage of inbound moves between 2019 and 2022 more people were relocating to the South Florida reporting area (Miami-Dade, Broward and Palm Beach Counties) than any other metro in the country.

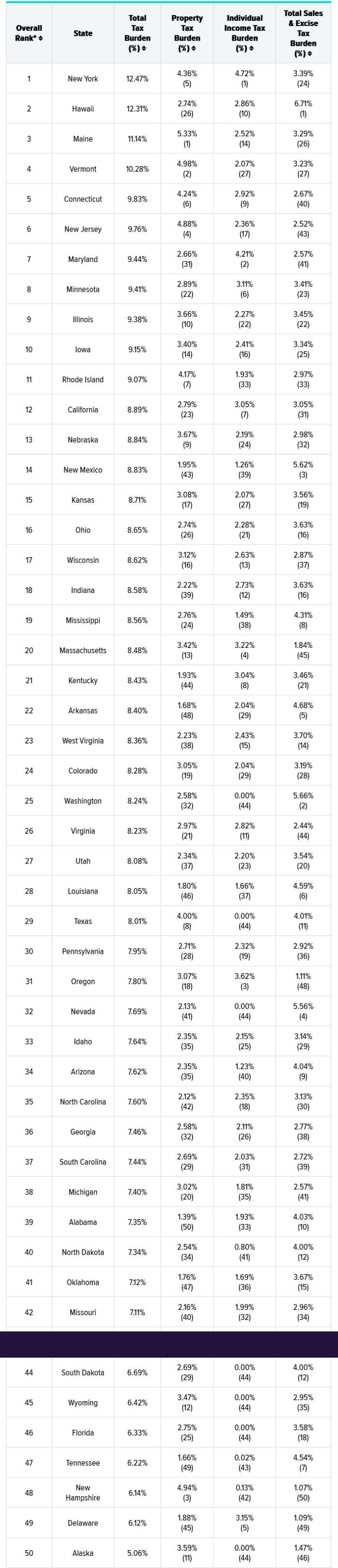

Aside from the weather (you never have to shovel sunshine out of your driveway) the main contributors to this influx of homeowners was undoubtedly Covid-19 and Taxes.

Once the Pandemic hit, many – especially in Finance thru the Northeast – began working remotely, wondered how smart it was to pay millions for a 900 sq. ft. co-op in a sub-arctic urban shithole when for equal money they could live in a luxury waterfront pool home in a tropical paradise.

In addition, California raised their State Income Tax to 16% to pay for cleaning streets where the homeless people go to the bathroom. We have a good friend, saw our blog, corrected us, claiming California only raised the State Income Tax to 13%. A tremendous consolation. Perhaps the local government should post that on billboards heading east, right before the Arizona state line, see how much difference that makes.

If you want to read our post concerning Net Domesticate Migration, click the link below.

Net Domestic Migration

Land of No Land

The old adage of "they're not making any more" has never applied more appropriately than it does to Fort Lauderdale. Broward County is not large, less than 30 miles north to south, and though it technically stretches halfway across the Floridian peninsula, around 45 miles, almost two thirds of it is comprised of wetlands, which is it's source of fresh water. In all Broward County there is only 471 square miles of developable dry land, and at this point it is fully developed.

The last large chunk of undeveloped land left in Broward, 61 (Everglades adjacent) acres by the corner of US-27 and Sheridan Street, was purchased by Amazon in 2021.

As a result, more and more people are moving into a location where there is no more empty land upon which to build. So this is not a "bubble." Barring cataclysmic natural disasters, asteroid impacts and/or total collapse of Western economies, it is all but impossible to envision housing prices ever retreating in Southeast Florida, particularly Broward County.

Back to Numbers

Year End 2022 stats show strength throughout Florida.

In Single Family, the Median Price increased 15.7% from $348,000 in 2021 to $402,500 in 2022, while the Average Sale Price went from $505,129 in 2021 to $562,442 in 2022, a gain of 11.3%.

Closed Sales, however, were down 18% from 350,516 in 2021 to 287,352 in 2022. This is undoubtedly another factor contributing to the rise in property values. In addition to, and possibly due to, the Median Percentage of List Price Received for the entire state of Florida was 100%.

In the South Florida reporting metro (Miami-Dade, Broward and Palm Beach Counties) the Median Price for a Single Family Home increased 17% from $265,000 in 2021 to $310,000 in 2022. Average Sale Price was up 13.9% from $446,100 in 2021 to $508,001 in 2022. Again, Closed Sales declined significantly, from 63,499 in 2021 to 51,232 in 2022, down 19.3%, while the Median Percentage of List Price Received went up from 96.7% to 98.5%.

Broward County, a more desirable location than Miami-Dade or Palm Beach, reported better stats than statewide or the South Florida reporting area. Median Price for Single Family homes rose 17% from $470,000 in 2021 to $550,000 in 2022. Average Sale Price increased 14.2% from $668,533 in 2021 to $763,768 in 2022.

Closed Sales declined 22.2% from 18,565 to 14,438, year over year, and Median Percentage of List Price Received remained at 100% for 2022.

As we cited previously, the Average Sale Price for a Single Family Residence in the city of Fort Lauderdale showed an increase of 14.3%, with Closed Sales registering a steep decline of 30% year over year. Drilling a little deeper we can see more affluent neighborhoods outperformed the County average. Zip Code 33301 (the Las Olas Isles) showed an increase of 42.9% in Median Price, and 40% in Average Sales Price. Zip Code 33304, which includes Fort Lauderdale Beach, the southern tip of Coral Ridge and the up and coming neighborhood of Poinsettia Heights, increased 30.3% in Median and 33.6% in Average Sale Price.

Check the Broward County City by City statistics, and the Broward County by Zip Code report to see more.

There is some interesting stuff:

Hillsboro Beach reported No Closed Sales, though last year their Median Price increased 46.4% to $18,295,000 based on a total of 6 Closed Sales, with Average Sale Price rising 14.4% to $15,800,000.

Lighthouse Point registered 178 Closed Sales, down 36.7% from 2021, with Median Price going up 26.4% to $1,388,888, and Average Sale Price increasing 25.4% to $1,823,269.

Lauderdale-by-the-Sea (or as we like to call it – Stoplights-by-the-Sea) reported 47 Closed Sales (down 17.5% from 2021), Median Price rising 57.7% to $1,222,500, Average Sale Price increasing 45.6% to $1,465,202.

Average Sale Price in the Town of Southwest Ranches shot up 47.4% to $2,240,290 on a total of 98 Closed Sales (down 37.6% from 2021). Median Price rose 30.2% to $1,482,500.

Condominiums and Townhomes

The Market for Condos and Townhomes showed similar resilience.

Statewide numbers report the Median Price for Condominium and Townhome properties rose 21.6% from $262,000 in 2021 to $306,500 in 2022. Average Sale Price increased from $382,963 to $445,305 year over year, representing a rise of 16.3%. Closed Sales were down 21.7% (from 160,177 in 2021 to 125,494 in 2022). Median Percentage of List Price Received went up to 99.9% from it's 2021 levels of 98.1%.

In the South Florida Metro Reporting Area (Miami-Dade, Broward and Palm Beach Counties) the Median Price of a Condo and Townhome increased 17% from $265,000 in 2021 to $310,00 in 2022. Average Sale Price was up 13.9% from $446,110 to $508,001 year over year. Closed Sales were down from 63,499 in 2021 to 51,232 in 2022, a decline of 19.3%. Median Percentage of Listing Price Received notched up from 96.7% to 98.5%.

In Broward County Median Price of a Condo and/or Townhome rose 14.9% from $271,500 to $250,000 year over year. Average Sale Price increased 20.9% from $296,632 in 2021 to $358,647 in 2022. Closed Sales went down from 21,858 in 2021 to 18,135 in 2022, a 17% decrease. Median Percentage of Listing Price Received rose from 2021's 96.9% to 99.1% in 2022.

Drilling down on the Condo numbers reveals some interesting stats.

In the city of Fort Lauderdale, Closed Sales declined 26.7% to 2,410, but the Average Sale Price shot up 39.1% to $784,049.

Further analysis reveals this increase is due largely to strong demand for the Beach.

Zip Code 33308, which includes the Galt Ocean Mile, showed a rise in the Average Sale Price of 31.8%.

Zip Code 33315 (encompassing South Lauderdale Beach, Harbor Beach and 17th Street Causeway) reported an increase of 37.8% in Average Sale Price.

And Zip Code 33304, which includes North Fort Lauderdale Beach, registered at increase in Average Sale Price of 71%.

2022 Year End Real Estate Market Reports

Click on buttons to download a pdf of statistical reports.

Florida 2022 Statewide Single Family

Florida 2022 Statewide Condos

Florida 2022 Statewide Metro Areas

South Florida 2022 Single Family

South Florida 2022 Condos

Broward County 2022 Single Family

Broward County 2022 Condos

Broward County Single Family City by City 2022

Broward County Condos City by City 2022

Broward County Single Family by Zip Code 2022

Broward County Condos by Zip Code 2022

Ft Lauderdale Real Estate News 5/11/2023

Real Estate "Experts" Finally Catch Up To What I've Been Telling People For Years

What The Heck Is Net Domestic Migration?

It's always nice when the Real Estate "Experts" finally catch up with me. The latest statistics from Realtor.com prove what I've been telling people for years - that the dramatic rise in South Florida Home Prices has been caused by a tremendous increase in DEMAND.

This is borne out by their analysis of Net Domestic Migration. Which is a fancy way of saying: Who's Moving Where.

Main contributors to this are the Pandemic and Taxes.

Once the Covid-19 Pandemic hit and many - especially those in Finance in the Northeast - started working remotely, they began to wonder why they were paying $2 Million for an 800 square foot co-op in a sub-arctic urban shithole when the same money could buy them a luxurious waterfront home in a tropical paradise.

Here's the view $2 Million buys you

in New York City

Tough choice. Nobody who lives here

ever dreams of being THERE

In addition, California raised their State Income Tax to 16% to pay for cleaning streets where the homeless people go to the bathroom.

And where are all these people moving when they finally wise up?

Change of Inbound Moves 2019-22

See Larger Image

States Sorted by Net Domestic Migration

See Larger Image

See Entire List

See Entire List

Florida Realtors 2021 Year-End Statistics

Fort Lauderdale Homes Up A Whopping 36%

The Average Sales Price for a Single Family Home in Fort Lauderdale rose a staggering 36.2% in 2021. In addition, the Median discount from Listing Price was Zero, meaning the vast majority of homes either sold for full asking or more than the Listed Price.

These startling figures are according to the latest year-end statistics released by the Florida Association of Realtors. Though seemingly incredible on face value these are accurate numbers. Statistics released by the Florida Realtors are generated by compiling sales reported through the MLS of local realtor associations across the state.

In 2020 the Average Sales Price for a Single Family Home in the city of Fort Lauderdale was $893,479; in 2021 it was $1,216,958.

The Median Sales Price, a more traditional indication of actual appreciation, for a Single Family Home in Fort Lauderdale increased 20%, from $500,000 in 2020 to $600,000 in 2021.

These figures are driven by the high demand for luxury waterfront properties from upscale buyers coming in from the Northeast and California.

Negotiation Is Futile

Stats regarding the discount from Listing to Sale Price are perhaps even more amazing. The "Median Percent of Original List Price Received" tracks the spread between asking and closing prices. With such an active Real Estate Market South Florida, and Fort Lauderdale in particular, are already known for being a tough place to negotiate. Historically, this Median Percent of Original List Price Received in Single Family Homes is around 95-96% of their asking, with Condominium and Townhome properties around 94-95%. In 2020, in Broward County, this number was 96.9% for Single Family, 94.9% for Condos (Villas and Townhomes). In 2021, however, the Median Percent of List Price received for a house was 100% and 98.9% for condos.

Condo Market Strong

The market for Condominium and Townhome properties was somewhat less sizzling, though still robust. The Average Sales Price for these properties rose 15.5%, from $488,172 in 2020 to $563,645 in 2021.

These figures were more in line with the Median Prices. In 2020 the Median Price for a Condominium and/or Townhome property was $335,000; in 2021 it was $383,750. That represents a year over year increase of 14.6%.

Once again we see the Fort Lauderdale location outperforming the State, South Florida and Broward County numbers.

Across the State of Florida, the Average Sales Price for a Single Family Home increased 25.8% (from $401,478 in 2020 to $505,129 in 2021). For South Florida (the reporting area comprised of Broward, Palm Beach and Miami-Dade Counties) the ASP increased from $634,142 in 2020 to $861,060 in 2021, rising 35%. Broward County reported an increase of 26.1%, from $530,166 in 2020 to $668,533 in 2021.

After languishing for some years the Condo market in Fort Lauderdale has also shown a sharp increase. The Average Sales Price for a Condominium or Townhome property rose 15.5% to $563,645 while the Median Sales Price went up 14.6% to $383,750.

Condo and Townhome numbers were strong throughout the state. Broward County reported a 19.8% increase in Average Sale Price (from $247,683 in 2020 to $296,632 in 2021) and a 15.1% rise in Median Sale Price (from $189,000 in 2020 to $217,500 in 2021. In the South Florida reporting area comprised of Broward, Palm Beach and Miami-Dade Counties the Average Sales Price for a Condominium and/or Townhome property rose 33.7% (from $333,738 in 2020 to $444,110 in 2021). For the same annum Median Sales Price increased from $220,000 in 2020 to $265,000 in 2021, or 20.5%. Across the state of Florida Average Sales Price for a Condominium or Townhome property went up 26.4% (from $303,051 in 2020 to $382,963 in 2021). Median Sale Price, statewide, grew from $215,000 in 2020 to $252,000 in 2021, an increase of 17.2%.

Home Prices Rise All Over South Florida

The strong housing market has led to sharp increases in home prices all across South Florida. The largest appreciation was in the small village of Sea Ranch Lakes, an exclusive enclave you enter through a guard gate along A1A just north of Lauderdale-By-The Sea, where Median Price rose 19.3% and the Average Sale Price of a Single Family Home increased 46.4%, from $1,701,000 in 2020 to $2,491,429 in 2021. Interestingly enough, 71% of all home sales in Sea Ranch Lakes were cash purchases, but before you get too impressed we should admit that was 10 of 14 total transactions.

Other municipalities:

In Pompano Beach, Median Price increased 21.9% (from $310,000 in 2020 to $378,000 in 2021) and the Average Sale Price rose 29.4% (from $447,642 to $579,351).

In Lighthouse Point, Median Price rose 37.4% (from $800,000 to 1,099,000) and Average Sale Price increased 22.7% (from$1,185,598 to $1,454,215).

Median Price for a Single Family Home in the city of Hollywood, Florida, increased 18.9% (from $349,000 in 2020 to $414,900); Average Sale Price went from $439,251 to $524,496, going up 19.4%.

Not surprisingly, the two sister Bedroom Communities of Davie and Cooper City showed almost identical numbers. Median Price increased 22.2% in Davie, 17.5% in Cooper City (respectively $495,000 to $605,000 and $464,00 to $545,000), while the Average Sale Price rose 17.8% in Davie (from $626,292 to $737,556) and 18.9% in Cooper City (from $516,525 to $614,049).

In the upscale western suburb of Weston Average Home Sale Price increased 22.3% (from $660,000 in 2020 to $808,426 in 2021), while Median Price rose from $567,000 in 2020 to $670,000 in 2021, a rise of 18.2%.

Another upscale suburb, Parkland, reported even better increases in home prices. Average Sales Price in this suburb rose 27.5%, while the Median Price went up 26.8% (respectively, from $773,674 to $986,395 and $690,000 to $$875,000).

Even historically middle-class neighborhoods are also showing significant appreciation in home values as it gets harder and harder for young buyers to find starter homes.

Single family residences in Plantation rose 24.4% in Average Sale Price (from $512,378 to $637,649) and 20.7% in Median Sale Price (from $447,500 to $540,000). Homes in Coral Springs increased 21.7% in Average Sales Price ($458,644 to $558,119) and 19,1% in Median ($445,000 to $530,000.

In Pembroke Pines SFRs rose 18.5% in Average Sale Price to $508,854 in 2021 from $429,438 in 2020, and the Median went up 14.3% to $478,500 in 2021 from the 2020 number of $418,500.

Coconut Creek reported an 18.3% increase in Average Sales Price (from $387,443 in 2020 to $458,178 in 2021, and a 17.1% jump in Median Price ($380,000 in 2020 to $445,000 in 2021.)

Interesting enough, the apparent outlier in Broward County seems to be the aforementioned seaside village of Lauderdale-by-The-Sea. (Or, as I prefer to call it - Stoplights-by-The-Sea) For some inexplicable reason the Average Sales Price for a Single Family Home in this little tourist trap along the beach rose only 1.4% (to $1,006,606 in 2021 from $992,834 in the previous annum), and the Median Price increased a paltry 4.0% (from$745,000 in 2020 to $775,000 in 2021. This is after showing sharp upticks last year, between 2019 and 2020, when Average Sales Price rose 26.5% and the Median 19.2%

Statistics for all the municipalities in Broward County can be found by clicking on the buttons below, following the links.

Will "The Bubble" Burst?

Don't hold your breath.

Clearly 36% year-over-year increases in home values are not sustainable, so I would not be surprised to see the market slow down a little, consolidate somewhat, but it is difficult for me to believe this is a "Bubble" which is going to burst. Unlike the crazy market in the early 2000s, which was driven largely by insane speculation, this is a demand driven spike in prices caused predominantly by an sizable influx of high-end real estate buyers from the Northeast and West Coast. Thanks to the Covid pandemic many people with high paying jobs in Finance and similar industries can now work from home. Why pay millions for a 1,200 square foot co-op in a sub-arctic urban craphole like New York City? That same money can buy you a luxury waterfront home in the tropical paradise of Fort Lauderdale. Aside from the Blade Runner congestion and the out-of-control homeless crisis in Los Angeles and San Francisco, California just raised its State Income Tax to 16%. As a result, many substantial and upscale home buyers are looking for more Bang For Their Buck in the proverbial Sunshine State, with a Homestead Exemption of your Primary Residence and no state income tax.

2021 Year End Real Estate Market Reports

Click on buttons to download a pdf of statistical reports.

Florida 2021 Statewide Single Family

Florida 2021 Statewide Condos

Florida 2021 Statewide Metro Areas

South Florida 2021 Single Family

South Florida 2021 Condos

Broward County 2021 Single Family

Broward County 2021 Condos

Broward County Single Family City by City 2021

Broward County Condos City by City 2021

Broward County Single Family by Zip Code 2021

Broward County Condos by Zip Code 2021

Research Florida Real Estate Statistics

Click Button below, go the Research & Statistics Page

of the Florida Association of Realtors.

Florida Market Reports

Many Reports are Publicly Available. Some are Members Only.

Should you be interested in a report which is only available to Association Members,

feel free to give me a call. I'll be happy to download one for you.

It's not like this stuff is Top Secret or anything.

Some Charts you might find interesting

S&P Case-Shiller Home Price Index – South Florida Metro

Miami-Dade, Broward and Palm Beach Counties

from 1987 through May 2023

South Florida (Blue) versus U.S.) Since 1987

Since The Pandemic

S&P Case-Shiller Home Price Index – South Florida Metro

from 2019 through May 2023

South Florida (Blue) versus U.S.) Since 2019

30 Year Fixed Mortgage Rate Average in the United States

Change of Inbound Moves 2015-22

Source: Realtor.com May 9, 2023

Total Tax Burden by State

Run Cursor over map to see where each State ranks.

Lowest to Highest

Total Tax Burden by State

Source: Wallethub May 9, 2023

States Sorted by Net Domestic Migration

Source: Realtor.com May 9, 2023

Real Estate Taxes

Run Cursor over map to see where each State ranks.

Lowest to Highest

Property Taxes by State

Florida Realtors 2020 Year-End Statistics

Fort Lauderdale Homes Appreciate 19%

Home values in Fort Lauderdale rose 19% in 2020.

To be precise: the Median Price of a Single Family Home in Fort Lauderdale, Florida increased to $500,000, which represents a rise of 19.0% from the previous year, according to statistics compiled and released by the Florida Association of Realtors.

What makes statistics reported by the Florida Realtors particularly valid versus other market reports: they are compiled from numbers generated through the MLS of local realtor associations across the state.

Other municipalities in Broward also reported significant increases in the Median Price of Single Family Homes. Not surprisingly, most of these were more upscale cities along the Atlantic coast: Deerfield Beach up 19.7% on 513 Closed Sales; Pompano Beach up 17.0% on 733 Closed Sales; Lauderdale-by-the Sea up 19.2% after 65 Closed Sales. Even Dania Beach showed a rise in the Median Home Price of 19.7% on 187 Closed Sales.

Now it doesn't take a Rocket Scientist to figure out something's going on when Single Family Homes in Dania Beach increase almost 20% in a single annum.

Aside from the rise in values, these stats seem to indicate home buyers paying a premium for proximity to the beach. Upscale communities in the western reaches of Broward County such as Weston and Parkland reported moderate gains of only 4% and 6.6% respectively (based on 826 and 695 Closed Sales. Other inland bedrooms communities report similar single digit increases: Coral Springs 8.5% on a significant sampling of 1,286 Closed Sales; Pembroke Pines 7.3% on 1,313 Closed Sales.

By the way, in case you're wondering - the 19% increase in Fort Lauderdale homes was based on a rather sizable sampling of 1,793 Closed Sales.

We also see a couple of interesting anomalies in these numbers.

For instance, the Median Price for a Single Family Home in the "city" of Lazy Lake rose an eye-popping 153%. For those who are not familiar with Lazy Lake it is a village of 13 Single Family Homes built around a little lake off North Andrews Avenue. The smallest incorporated city in Broward County, it has one street and a population of 20-some people. This meteoric rise in home values is based upon ONE Closed Sale of $1,080,000.

To the opposite extreme we find Hillsboro Beach, undoubtedly the wealthiest municipality in the County, a row of impressive beachfront mansions stretching north from the Hillsboro Inlet. Based on 7 Closed Sales in 2020 the Median Price increased 25% to $12,500,000. It is all interesting to note these numbers represent a cash purchase ratio of 85%. In other words - 6 out of the 7 Buyers paid cash. Want to have some more fun, figure out the debt service the one Buyer who financed might be paying. On a $10 Million mortgage, even at 3.0%, the interest could total $25,000 a month.

Another anomaly is Southwest Ranches, a community comprised of predominantly multi-acre parcels where residents keeps horses and animals. The only western municipality to show a significant increase, Median Price rose 24.1% to $862,500 based upon 120 Closed Sales.

Where Do I Invest?

Some of the more mercenary of our readers (a.k.a. real estate investors) might be wondering, as you go through these numbers - where's the best place to invest? To me these stats indicate transitory neighborhoods just inland from the coast might offer the best bang for your buck. I never though I'd say these words, but take a look at Oakland Park. From its eastern-most border along Federal Highway in North Fort Lauderdale, stretching west through neighborhoods which are up on their way up, Median Sale Price in Oakland Park increased 13.3% to a relatively reasonable $340,000 on a sampling of 463 Closed Sales.

Condominiums & Townhomes

In Condominiums and Townhomes the statistics tell a different story. This market had been languishing for some years before the influx of Buyers from other states: tax refugees from California, people from the Northeast who came to realize the importance of outdoor living through the Covid-19 pandemic.

Median Price in Fort Lauderdale increased to $335,000, a healthy rise of 11.7% on a substantial sampling of 1,933 Closed Sales. The coastal town of Lauderdale-by-the-Sea also reported a significant rise of 15% to a Median Price of $390,000 on 214 Closed Sales.

Still, in Condos and Townhomes, many municipalities in the western reaches of Broward County still reported healthy increases. Weston: Median Price $268,500, up 9.6% on 346 Closed Sales.

Hollywood: up 13.9% to $205,000 on 1,061 Closed Sales.

Coral Springs: Median Price $159,000, a rise of 9.7% on 586 Closed Sales.

Davie: up 10.3% to $215,00 after 490 Closed Sales.

The most surprising results in the Condominium and Townhome market may be some of the more economical (shall we say) cities through the middle of Broward County.

Lauderdale Lakes up 16.8% to $75,950 on 253 Closed Sales.

North Lauderdale up 19.7% to $191,000 on 207 Closed Sales.

Lauderhill up 16.9% to $95,000, 623 Closed Sales.

Sunrise up 14.0% to $138,000 on 911 Closed Sales.

Tamarac up 13.1% to $155,000, 929 Closed Sales.v

See 2020 Year-End Real Estate Reports

City by City in Broward County

Click on buttons to call up a pdf of selected reports

Broward County Single Family City by City 2020

Broward County Condos City by City 2020

Drill Down Deeper

2020 Median Price Increase by Zip Code

Broward County Single Family by Zip Code 2020

Broward County Condos by Zip Code 2020

Free Download

Broward County Zip Code Map

Broward County Zip Code Map

Year End Real Estate Market Reports

Click on buttons to download a pdf of statistical reports.

Florida 2020 Statewide Single Family

Florida 2020 Statewide Condos

Florida 2020 Statewide Metro Areas

South Florida 2020 Single Family

South Florida 2020 Condos

Broward County 2020 Single Family

Broward County 2020 Condos

Broward County Single Family City by City 2020

Broward County Condos City by City 2020

Broward County Single Family by Zip Code 2020

Broward County Condos by Zip Code 2020

2020 Year-End Statistics from Florida Realtors

Home Price Appreciation The Best in Fort Lauderdale

I hate being right all the time. For years I've been telling people Fort Lauderdale is the best location in Florida, especially when it comes to Real Estate, particularly in Home Value Appreciation.

Statistics released by the Florida Realtors for year-end 2020 prove this in dramatic fashion.

In 2020 the Median Price of a Single Family Home in Ft. Lauderdale, Florida increased 19.0% to $500,000 based on 1,793 Closed Sales. This is essentially double the appreciation in home values reported for the state. Median Price for a Single Family in Florida rose 9.6% in 2020. Moreover, the South Florida reporting area, comprised of Miami-Dade, Broward and Palm Beach County, showed an increase in Median Price of 10.6%.

Forget Low-Balling. According to these stats from the Florida Realtors, compiled from the MLS of local real estate associations across the state, Sellers received 97.7% of their asking price in 2020, versus 96.% in the preceding annum, an increase of 1.2%. That's statewide. The numbers are a little less for the reporting area of South Florida: 96.4% Median Percentage of Original List Price Received versus 95.3% in 2019, a 1.1% Rise. In Broward County Seller's received 96.9% of their listed price, up 1.1% from the previous year.

Condominiums & Townhomes

The market for Condominiums and Townhomes in Fort Lauderdale and Broward County has languished for the last several years after shooting up so dramatically. Now that Real Estate has heated up we are finally seeing some upward momentum in these prices, however, not quite as impressive as we find in Single Family.

In Fort Lauderdale, the Average Sale Price for a Condo or Townhouse increased 12.4% to $488,172 based on 1,993 Closed Sales. Statewide, the Average Sale Price for Condominiums and Townhomes rose 10.9% to $303,051. Through the South Florida reporting area of Miami-Dade, Broward and Palm Beach Counties, the AVP increased 9.9% to $333,738, and Broward reported a rise of 11.6% of $247,683.

Once again we see a clear line showing when it comes to Real Estate appreciation Fort Lauderdale is the best location: the whole state reports an increase of 10.9%, South Florida 9.9%, Broward County 11.6%, and Fort Lauderdale 12.4%.

For the record, even in Condos and Townhomes it is still a Seller's Market. Across the state of Florida the Median Percentage of Original List Price received in 2020 was 95.7%, up from 95.0% the previous year, an increase of… Well, hopefully, you can do the math. In the reporting area of South Florida Sellers got 94.5% versus 94.0% the preceding annum. In Broward County this number also increased half a percent, from 94.4% in 2019 to 94.9% in 2020.

Not That Bubble Thing Again

Okay, every time we see such a dramatic rise in home values we get the knee-jerk reaction, ventriloquist dummies running around like Chicken Littles with their heads cut off screaming: "It's a bubble! It's a bubble! It's a bubble!"

First, it is important to view matters in its historical context. Florida Real Estate, and particularly South Florida, has always operated through a series of Boom and Bust Cycles. Broward County and Fort Lauderdale is a unique market all its own which does not march in step with national or statewide trends. Home Values increase steadily - 5-6% annually for a couple years. Then they go nuts, shoot up at a tremendous rate. Twenty percent a year price appreciation is not sustainable, and these sudden increases are usually followed by some kind of a pull back. So it would not be a surprise to see home values retreat somewhat once this incredible hot streak peters out.

What would be a surprise, however, would be for home values to absolutely "crash."

We know the Median Price for a Single Family Residence in Fort Lauderdale rose 19.0% in 2020. Based upon what we are seeing in the market, this trend is continuing so far in 2021. According to statistics the Florida Association of Realtors released for the First Quarter of this year, the Median Price increased 20.8% (over the First Quarter of 2020). Assuming no Acts of God, the total collapse of Western Civilization, this hot market still has a ways to run. Inventory is tight. In large part, much of the run-up in home values has been driven by the influx of buyers from other states: tax refugees from California, others fleeing the Covid-19 ramifications through the Northeast, where housing prices still make Fort Lauderdale look like a bargain.

Remember, there is no more undeveloped land in Broward County, no more wide open tracts upon which to build new developments.

In addition, new reports reveal many Homeowners who have fallen behind in rent or their mortgage have started to make payments, which should eliminate (or at least mitigate) what many thought might be a coming wave of distressed properties hitting the market once the band on evictions and foreclosures was finally lifted.

And (though I get tired of reminding people this) it is inconceivable we will ever seen anything like the real estate crash of 2005. More than just a sudden increase in home prices, that was driven by banks giving out extremely bad mortgages, appraisers getting chummy with Listing Agents.

Even so, following that great market crash, home prices in South Florida simply retreated to where they should have been. I have the illustration above on my "Investor Central" page. It is the Standard & Poor's / Case-Shiller Home Price Index for South Florida, released circa 2015 maybe, which shows the big spike in valuations in the early 2,000s, then the precipitous decline. I added the trend line, for it shows how, even after the fall, home prices still came down to roughly where it should have been, perhaps a bit higher.

You might also check the numbers along the very left. I believe these numbers are the Median Price. According to the Year-end Statistics for 2020, the Median Price for a Single Family Home in South Florida was $398,000.

Coming Soon Listings

Not Active on MLS Yet

Before they appear on big Real Estate sites

Click Button Below

Sneak Previews

Get A Head Start

On Your Home Search

5 Star Rated Realtor

Internet Marketing Expert

Click This Button to See

What Clients Say

About Jim Esposito

LIST YOUR HOME

with

The Best Realtor in Ft. Lauderdale

Click The Button Below to Receive a Complimentary

Property Evaluation

Of the Market Value of Your Home!

Before You List

You Should Read

10 Tips to Boost Home Value

Real Estate Pros Share Valuable Insights How To Get The Most for Your Home

Increase Home Value

Fort Lauderdale Beach Webcam

Click Image See Live Webcam

Ft Lauderdale Home Value

ANALYSIS & PROJECTIONS

Real Estate Projections

A Comprehensive and Intelligent Consideration of What's Ahead For The Local Real Estate Market

FREE MLS ACCOUNT

Save Listings

Saved Searches

Email Alerts & Updates

Client Log In

Registration Required

Most Recent Real Estate Statisics

Fort Lauderdale, Broward County, South Florida, Statewide & Beyond

Just The Facts

Latest Statistics

Home Buyer Assistance

Programs Offered

by Broward County

& The State of Florida

Make It More Affordable

to Buy A House

Find Out More!

Homebuyer Programs

Sitio en Español

Site en Français

Site em Português

Seite auf Deutsch

CEOs & Founders

of

For Sale By Owner

Buy Owner

Craigslist

List THEIR Homes

with

Realtors!

Read About It Here

Like – I Know What I Say, But Now We're Talking

MY MONEY!