Selling My Home

Great Deals

Property Search

Foreclosures

Income Property

New Construction

Downtown

Neighborhoods

Condos

Rentals

Investor Central

Real Estate Blogs

Resources

Testimonials

Webcams

Client Log-in

Contact Us

Buy Fort Lauderdale Real Estate: More Affordable with Programs Offered by State of Florida & Broward County

Florida First Time Homebuyer Program

The First Time Homebuyer Program makes purchasing a home more affordable for low-to-moderate income families and individuals by offering fixed, low-interest rate mortgage loans. In addition, Florida Housing also offers down payment and closing costs assistance to eligible borrowers, which can greatly reduce the out of pocket expense to the buyer.

Find Out More Info About the Florida First Time Homebuyer Program

First Time Homebuyers

Florida Housing Mortgage Credit Certificate Program

The Florida Housing Mortgage Credit Certificate (MCC) Program can help first time homebuyers save money each year that they live in their home. With the MCC Program the homeowner can claim up to 50 percent of their paid mortgage interest each year as a TAX CREDIT on their federal IRS tax return. The credit is capped at $2000 annually and any remaining mortgage interest not included as part of the TAX CREDIT is still eligible for the home mortgage interest deduction on their federal tax return.

Each year, a homeowner may claim a dollar-for-dollar reduction of income tax liability on 50 percent of the mortgage interest on their first mortgage, reducing the amount of federal taxes owed by as much as $2000.

Florida Housing’s MCC Program is for first time homebuyers purchasing a home, non-first time homebuyers purchasing a home in targeted areas in Florida or for eligible veterans purchasing a home anywhere in Florida.

The Florida Housing MCC can be issued with any participating lender’s fixed rate first mortgage loan. It cannot be used with our First Time Homebuyer (bond loan) Program or local housing agency bond loans.

The MCC Program has income and purchase price limits. These limits differ from county to county as well as by household size. Please contact a participating lender if you have questions or would like to apply for a MCC.

FAQs

What is a Mortgage Credit Certificate?

A Florida Housing Mortgage Credit Certificate (MCC) allows the homebuyer to claim a tax credit for 50 percent of the mortgage interest paid per year, capped at $2000 annually. It is a dollar-for-dollar reduction against their federal tax liability.

Who is eligible to receive an MCC?

The program is open to those individuals and families who:

• meet income and home purchase price limits;

• meet the qualifying requirements of a mortgage loan;

• will use the home as their primary residence; and

• have not owned a home as primary residence in the past three (3) years (first time homebuyers), are eligible veterans* , or the property is located in a targeted area.

When does the MCC expire?

The MCC does not expire as long as the home remains your principal residence and you are paying mortgage interest. It will expire only when you sell or no longer use the house as your primary residence. If you sell your home in the first nine years, you may be subject to the Federal Recapture Tax.

How much of a tax credit can be claimed under the MCC program?

The size of the annual tax credit will be 50 percent of the annual interest paid on the mortgage loan. The credit cannot be larger than the annual federal income tax liability, after all other credits and deductions have been taken into account.

*eligible veteran: A person who served in the active military, naval, or air service of the United States, and who was discharged or released therefrom under conditions other than dishonorable, as defined in 38 USC Section 101

Find Out More Info About the Florida Housing Mortgage Credit Certificate Program

Florida Housing Mortgage Credit

Income Limits

Purchase Price Limits

Broward County Mortgage Credit Certificate Program

The Housing Finance Authority of Broward County has launched a Mortgage Credit Certificate Program to help reduce home loan financing costs for qualified homeowners in Broward County.

The Mortgage Credit Certificate program entitles qualified applicants to a federal income tax credit in an amount of up to $2,000 annually. This enables qualified owners or buyers, who owe federal income taxes, to benefit from a dollar-for-dollar reduction of their tax bills. Additionally the homeowner will continue to receive the tax credit each year they continue to live in the home financed under the program.

The Mortgage Credit Certificate is not a mortgage; however, it may be used in conjunction with a first mortgage from a participating lender (except a mortgage revenue bond loan.) Borrowers must meet normal mortgage underwriting requirements, which demonstrate credit worthiness, and meet the program's income and home purchase price requirements.

New Loan Requirements

Except in the case of a loan to refinance a Qualified Subprime Loan, an MCC cannot be issued in conjunction with the acquisition or replacement of an existing loan or mortgage; however, an MCC can be used in conjunction with the replacement of construction period loans or bridge loans of a temporary nature. Construction period or bridge loans must be for no longer than 24 months. The Participant must obtain from the Applicant, via the Program documents, a statement to the effect that the loan being made in connection with the MCC will not be used to acquire or replace an existing mortgage or land contract, subject to the exceptions outlined above.

FAQs

What does the MCC do?

The MCC reduces the amount of federal income tax paid giving more available income to qualify for a mortgage loan and assist with house payments. The MCC allows 10-50 percent (currently at 30 percent and subject to adjustment) of the mortgage interest paid each year to be used as a “tax credit.” As a Mortgage Credit Certificate holder, you will receive a direct dollar-for-dollar federal income tax reduction. Depending on your circumstances, you may enjoy a savings through increased monthly take home pay or as a year-end tax refund. The MCC may help you qualify for larger home or assist you in qualifying for a mortgage loan when you otherwise would not.

Is the MCC a mortgage?

No, the MCC is not a mortgage, but may be used in conjunction with a first mortgage from a participating lender (except a mortgage revenue bond loan.) Borrowers must qualify using standard credit requirements. Borrowers may also use any down payment assistance and grant programs available through any source acceptable to the lender.

What is the difference between a tax credit and tax deduction?

A mortgage interest deduction differs from a mortgage tax credit. A “tax credit” entitles taxpayers to subtract the amount of the credit from their total federal income tax liability, receiving a dollar for dollar savings.

A “tax deduction” is subtracted from the adjusted gross income before federal income taxes are computed. Therefore, with a deduction, only a percentage of the amount deducted is realized in savings.

How much of a tax credit can be issued under the MCC?

The maximum amount of the tax credit shall not exceed $2,000.00 per year for MCC rates in excess of 20%.

How do I qualify?

Borrowers must be first-time homebuyers who have not owned their principal residence during the last three years.* Borrower must meet normal mortgage underwriting requirements which demonstrate credit worthiness. There are income and home purchase price requirements in this program.

*This requirement is waived for homes purchased within a targeted area.

What is a targeted area?

Census tract in which seventy percent (70%) or more of the families have an income which is eighty percent (80%) or less of the statewide median family income.

Are there additional costs?

Yes, there is an MCC application fee of $175. The fee is paid at closing and subject to change.

Income and Home Purchase Price Limits

• 1-2 Family Members: Household Income may not exceed $82,800; Purchase Price may not exceed $337,500 in Non-Targeted area, or $412,500 in Targeted area.

• 3-Plus Family Members: Household Income may not exceed $96,600; Purchase Price may not exceed $337,500 in Non-Targeted area, or $412,500 in Targeted area.

Effective June 2014 (Subject to periodic adjustment)

Where can I buy and what type of home can I purchase?

A new or existing single family home (attached or detached), condo, townhome, certain manufactured homes and Plan Unit Development must be within Broward County.

What happens when I move?

If you move in the first full nine years you own the home, make a profit on the sale, and have income that exceeds the allowable income at the time of the sale, you may be subject to recapture. For more information, ask for a recapture brochure.

What's the next step?

• Have a participating lender pre-qualify you for a first mortgage loan and determine if an MCC benefits you.

• Locate a home by using a professional such as a realtor.

• Make an offer for the property.

• Return to your lender and comply with lender requirements.

I already own a home, do I qualify?

No, the MCC must be applied for prior to purchasing your home.

Find Out More Info About the Broward County Mortgage Credit Certificate Program

Broward County Mortgage Credit

Jim Esposito

First Time Home Buyer Real Estate Agent

954-785-8558 Office

954-336-3776 Mobile

Mobile Users

Call MeComing Soon Listings

Not Active on MLS Yet

Before they appear on big Real Estate sites

Click Button Below

Sneak Previews

Get A Head Start

On Your Home Search

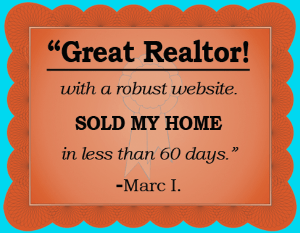

5 Star Rated Realtor

Internet Marketing Expert

Click This Button to See

What Clients Say

About Jim Esposito

LIST YOUR HOME

with

The Best Realtor in Ft. Lauderdale

Click The Button Below to Receive a Complimentary

Property Evaluation

Of the Market Value of Your Home!

Before You List

You Should Read

10 Tips to Boost Home Value

Real Estate Pros Share Valuable Insights How To Get The Most for Your Home

Increase Home Value

Fort Lauderdale Beach Webcam

Click Image See Live Webcam

Ft Lauderdale Home Value

ANALYSIS & PROJECTIONS

Real Estate Projections

A Comprehensive and Intelligent Consideration of What's Ahead For The Local Real Estate Market

FREE MLS ACCOUNT

Save Listings

Saved Searches

Email Alerts & Updates

Client Log In

Registration Required

Most Recent Real Estate Statisics

Fort Lauderdale, Broward County, South Florida, Statewide & Beyond

Just The Facts

Latest Statistics

Home Buyer Assistance

Programs Offered

by Broward County

& The State of Florida

Make It More Affordable

to Buy A House

Find Out More!

Homebuyer Programs

Sitio en Español

Site en Français

Site em Português

Seite auf Deutsch

CEOs & Founders

of

For Sale By Owner

Buy Owner

Craigslist

List THEIR Homes

with

Realtors!

Read About It Here

Like – I Know What I Say, But Now We're Talking

MY MONEY!